The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

9:58 am

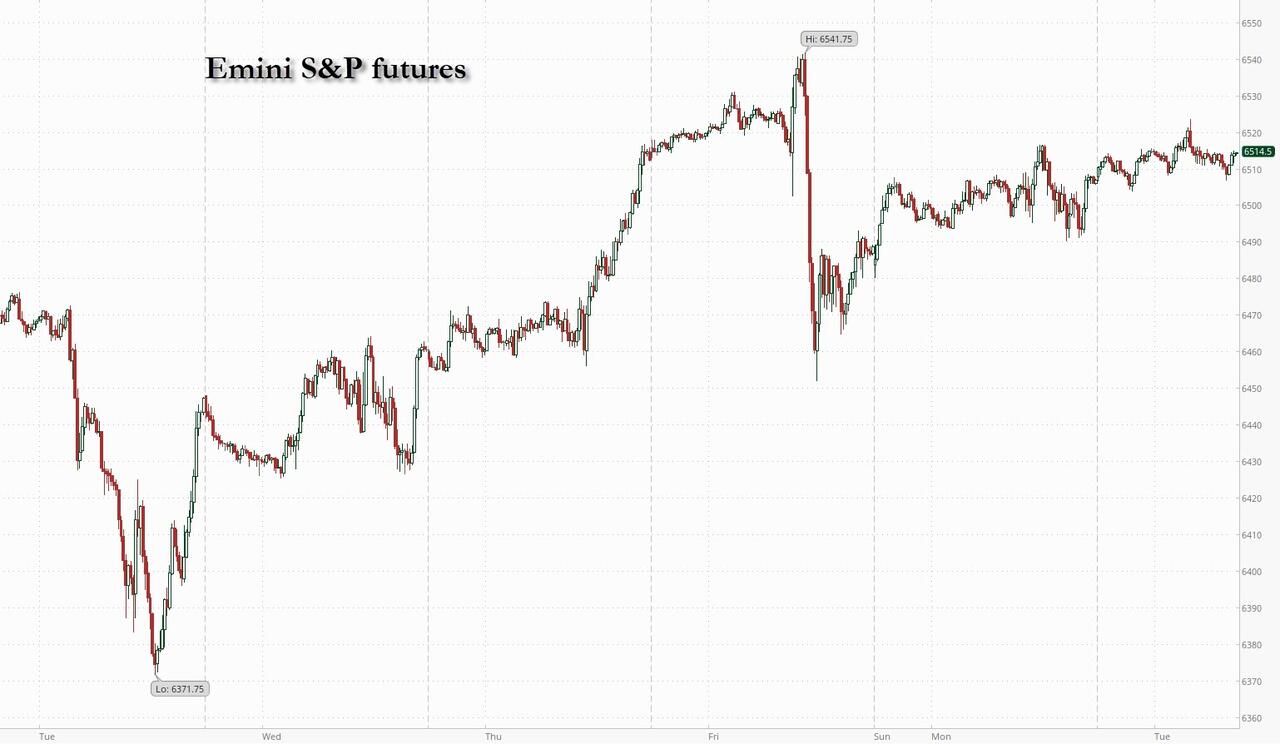

SPX has challenged/bounced from the 2-hour mid-Cycle/Intermediate support and has tested the short-term support at 6404.00 thus far. It may test the trendline near 6415.00 yet today. It would not be wise to attempt to buy the dip with the SPX having declined beneath a critical trendline. A more significant bounce may be found at the 50-day Moving Average at 6317.00.

7:50 am

Good Morning!

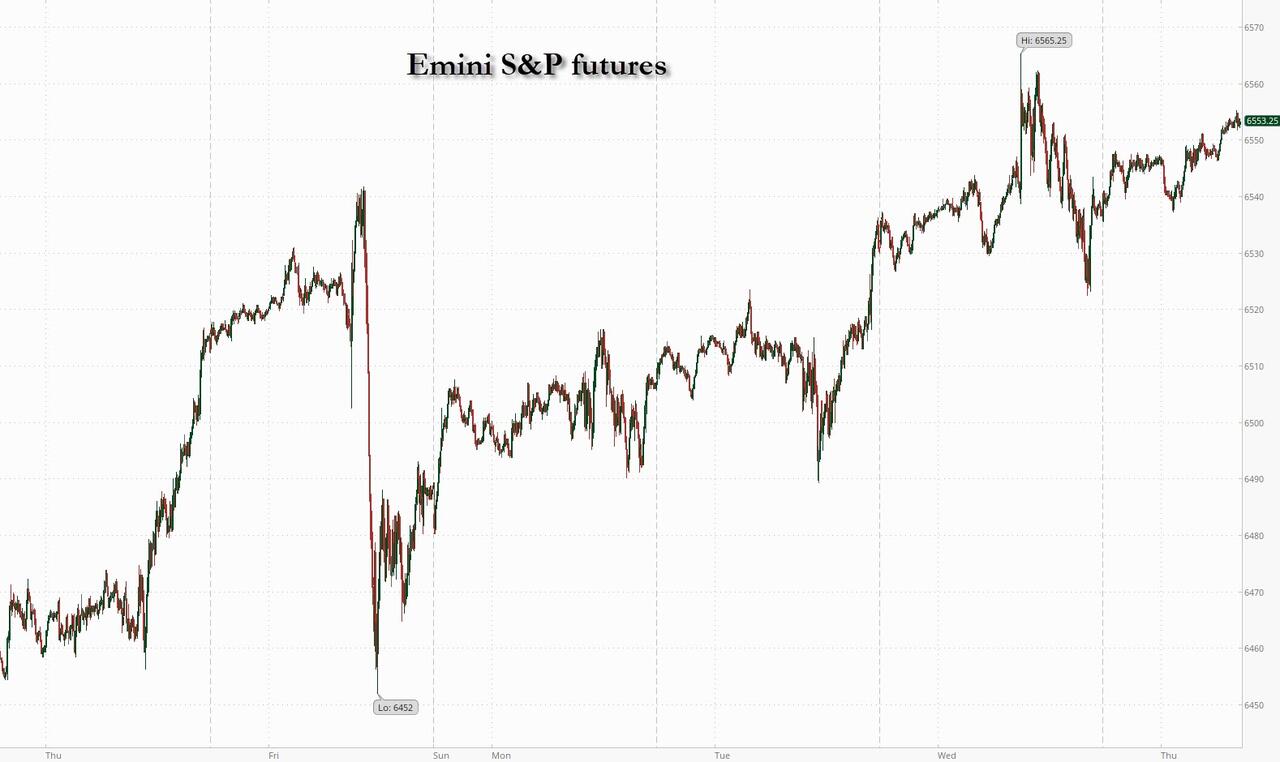

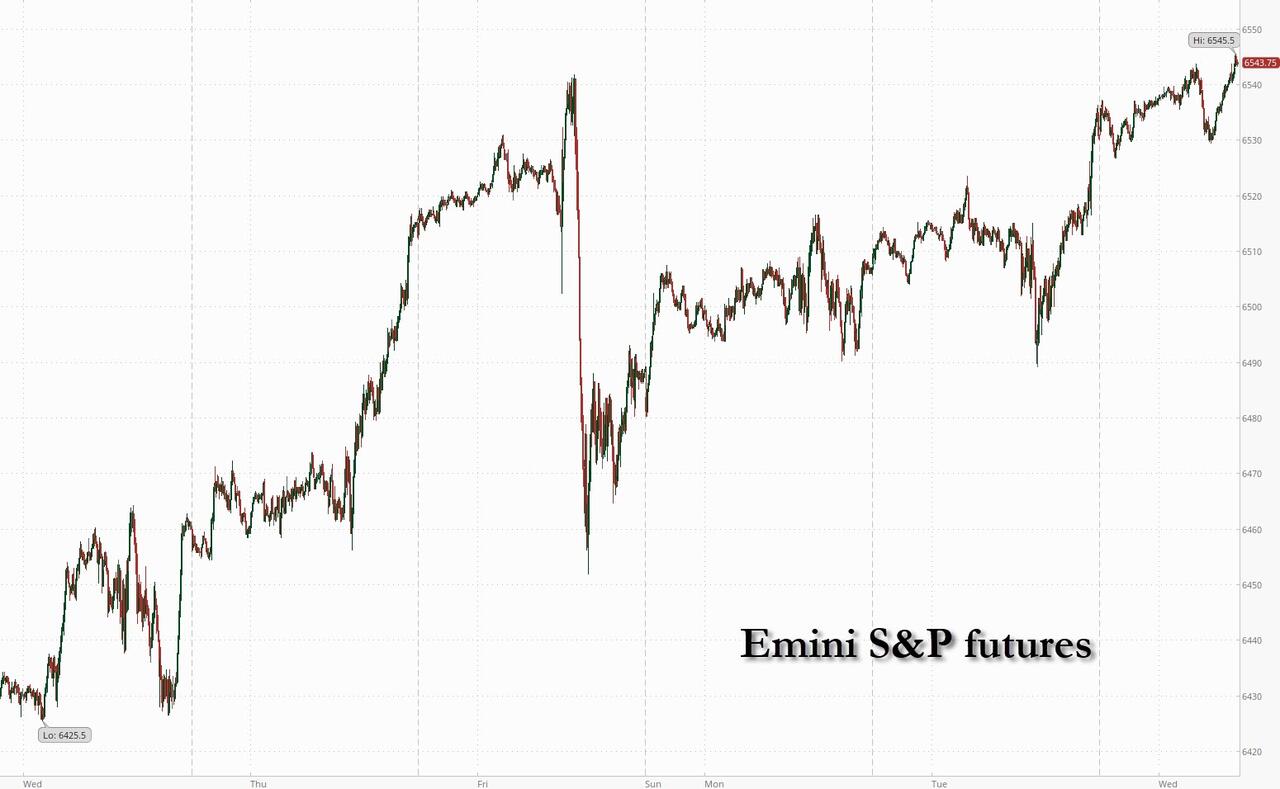

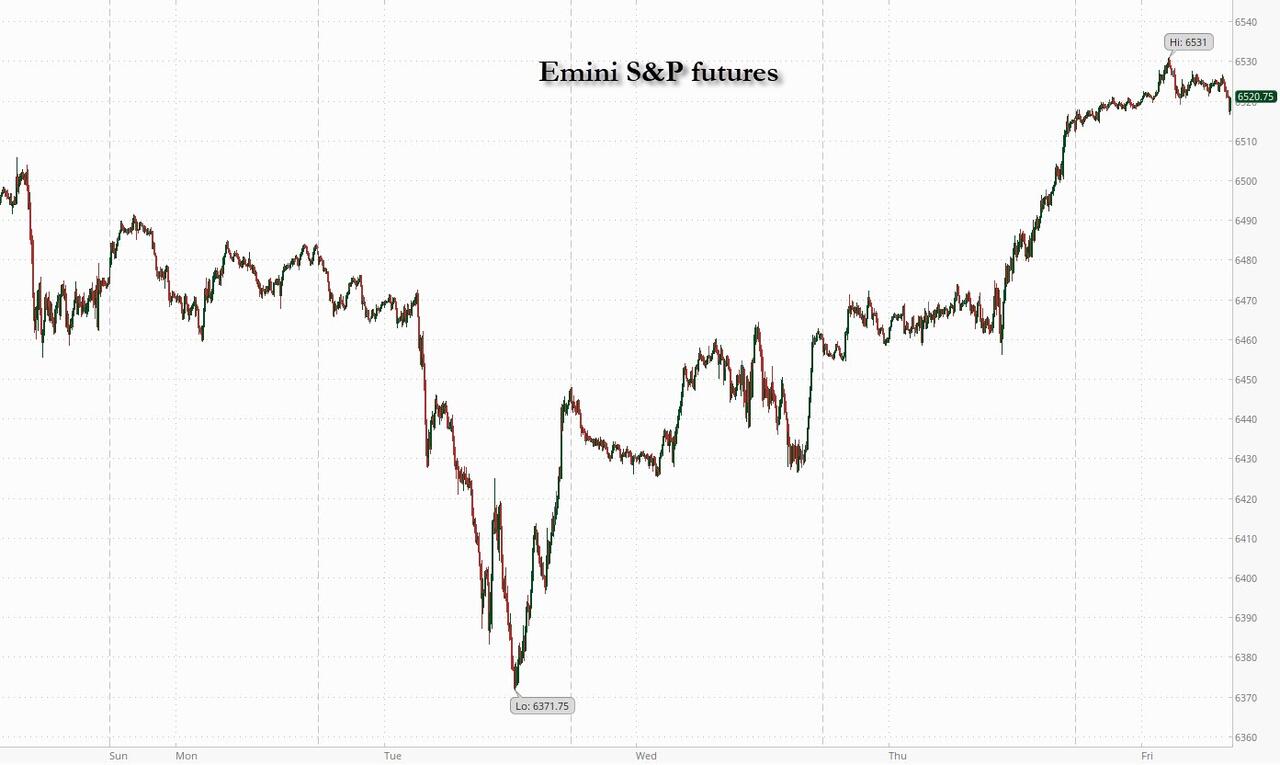

SPX futures sank to a holiday weekend low of 6410.70 (thus far), testing the Ending Diagonal trendline at 6404.00. A decline beneath that level triggers an aggressive sell signal in the SPX. The 50-day Moving Average lies 100 points lower at 6303.00, where a confirmed sell signal may be found. Today’s activity may show some rising volatility. An aggressive sell signal may show some blow-back, but also offers the best positioning for the downtrend to follow. September has a history of being a tough month. However, commercials and individual investors are 100% net long at the end of last week. With mutual funds cash at an extreme low, there may be little liquidity to cushion a decline. A negative payrolls number on Friday may greenlight a 50 basis point cut by the Fed. The buyback blackout begins in the second half of September. The Cycles Model proposes a possible month-long decline with trending strength appearing in week 2 and climaxing in week 3.

Today’s options chain shows Max Pain at 6460.00. Long gamma may arise above 9500.00 while short gamma resides beneath 6400.00.

ZeroHedge reports, “Following our warning that September tends to be the worst month for the S&P by a wide margin…

… US equity futures are acting accordingly and tumble on the first trading day of the month, dragged lower as part of a global risk-off tone sparked by a selloff in global government bonds which spooked investors and sent the dollar surging into a critical two weeks of macro data. As of 8:00am ET, S&P futures are down 0.8%, and Nasdaq futures slide 1%, deepening the tech-driven selloff that closed out last week. Nvidia led premarket losses among the Mag7 retreating 2.2% with all Mag7 names lower in premarket trading. Energy names are outperforming as crude rallies ahead of an OPEC+ meeting this week. Commodities are weaker ex-Energy complex as WTI heads for its best day since late July; gold hit a record high above $4,500 before retracing some of the move; silver also broke out to a new 11 year high, however subsequent USD strength is pressuring precious metals. The dollar posted its biggest gain since July, putting it on course for a first advance in six days. Today’s macro data focus is on ISM-Mfg and Construction Spending.”

VIX futures shot up to 18.57 thus far this morning, breaking through the 50-day Moving Average at 16.46 and triggering a buy signal. Most analysts may only recognize a breakout above the trendline near 20.00 a a signal for action.

Tomorrow’s options chain shows short gamma clustered at 14.00-15.00. Long gamma resides above 20.00, but trails off at 30.00. There is an institutional presence at 50.00

Bitcoin may have made its Master Cycle low yesterday at 107271.00. A potential buy signal may await above the 100-day Moving Average at 111715.00. The Cycles Model suggests a rally through early October. Should it rise above the 50-day Moving Average at 116060.00, it may test the Cycle Top resistance at 127506.00 by October. Bitcoin futures, which expire on August 25, are trading at a premium.

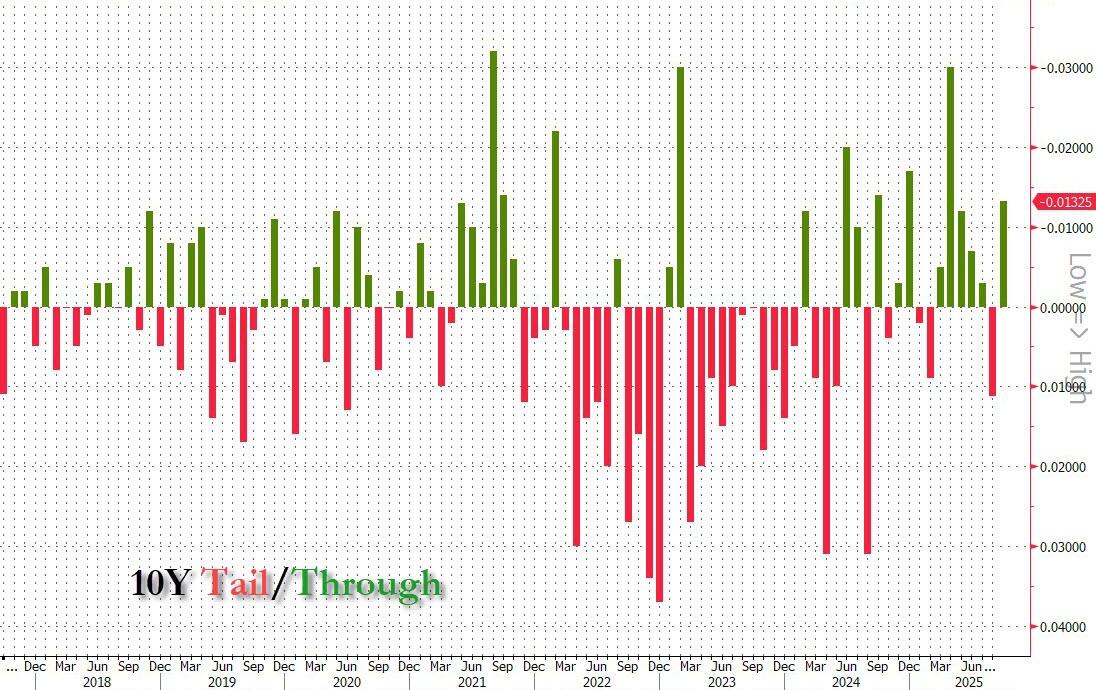

TNX has leaped to a morning high at 43.00, nearly reaching Intermediate resistance at 43.10, above which lies a possible (yields) buy signal. The 50-day Moving Average lies at 43.22, where universal recognition may be made. Bond vigilantes have appeared with a vengeance, especially in Japan and Europe. Will the US bonds follow?

ZeroHedge reveals, “UK capital markets are creaking once again as investors’ confidence in the Starmer government is crushed amid concerns over the fiscal outlook.

The yield on long-dated UK bonds rose to the highest since 1998…”

USD futures rose to 98.59 this morning as bond yields worldwide have spiked. It surpassed the 50-day Moving Average at 98.04, creating a universally recognized buy signal. While the reversal may have come early, it may be reinforced with a blast of trending strength by the weekend.

Gold futures may have made a new all-time high yesterday, but gold traded on the Chicago Mercantile Exchange may not release its record until the end of today. The observation being made is that it may also have reached its Master Cycle high in the process. Triangles often finalize their formation with a false breakout misleading investors on a wild goose chase to nowhere. Should that be so, the Cycles Model suggests an imminent decline lasting until mid-October.